Article Directory

Bitcoin's Nosedive: Is the Crypto Party Over?

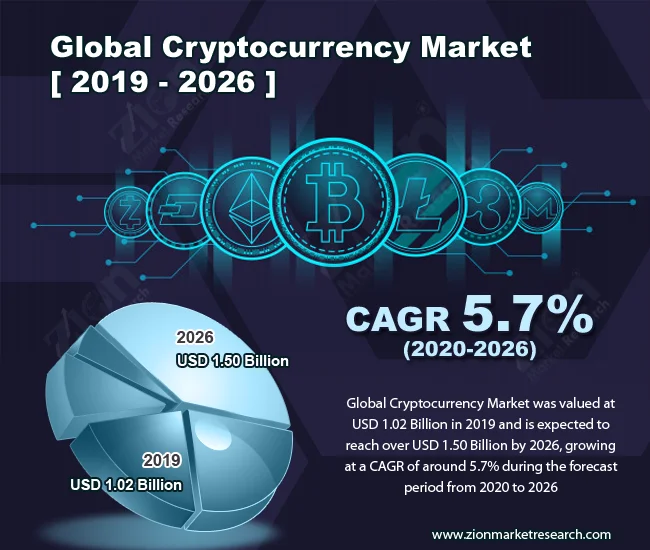

Bitcoin's recent plunge below $85,000 is raising eyebrows, even in the notoriously volatile cryptocurrency market. The flagship crypto has shed roughly a third of its value since its October peak, wiping out over $750 billion in market capitalization, according to CoinGecko. That's a staggering amount of wealth evaporated in a relatively short period.

Interest Rate Impact

The immediate trigger appears to be comments from a Bank of Japan official hinting at a possible interest rate hike. Arthur Hayes, co-founder of BitMEX, pointed to this directly on X, noting that "$BTC dumped [because] BOJ put Dec rate hike in play." The logic is sound: higher interest rates make safer assets more attractive, pulling capital away from riskier bets like crypto.

Broader Market Correction

It's not just Bitcoin feeling the pain. Crypto-related stocks like Robinhood and Coinbase have also taken a hit, and other major cryptocurrencies, including Ethereum and XRP, are down. This suggests a broader market correction, not just an isolated Bitcoin blip. James Butterfill, head of research at CoinShares, notes heavy selling by whales following the four-year cycle narrative, with large holders selling more than $20 billion since September.

Bitcoin as a Risk Indicator

Nigel Green, CEO of deVere Group, offers another perspective, suggesting that Bitcoin is increasingly behaving as a leading indicator for broader risk assets, particularly U.S. technology stocks. He points to a correlation between Bitcoin's performance and the Nasdaq Composite, where a 4% pullback in tech has translated into a near 30% drop in Bitcoin's value. This correlation—and I use that term loosely, as correlation doesn't equal causation—is worth watching.

Federal Reserve's Role

Investors are now laser-focused on the Federal Reserve's upcoming rate decision. The market is pricing in an 87% likelihood of a rate cut, according to CME FedWatch. (That's a surprisingly high degree of certainty, given the Fed's notoriously opaque communication style). However, Adam Crisafulli, head of Vital Knowledge, warns that even a rate cut could be accompanied by hawkish forward guidance, which could still hurt risk assets.

Decoding the Dip: More Than Just Interest Rates?

But are interest rate hikes and Fed policy the whole story? I'm not convinced. The cryptocurrency market operates on a complex interplay of factors, including technological advancements, regulatory developments, and, perhaps most importantly, market sentiment.

Psychological Factors and Leverage

The articles mention a "broader decrease in risk appetite" and "unwinding among fast-moving traders." This suggests a psychological element at play. After a period of rapid gains, some investors are likely taking profits, while others are simply growing nervous about the sustainability of the rally. We're seeing rapid liquidations across major exchanges, which indicates that traders were holding too much leverage in one direction. Solana, for example, saw one of the sharpest reductions in open interest.

Predictions and Puzzles

Eric Schiffer, CEO of the Patriarch Organization, remains bullish, predicting a rebound next year as the Fed further eases interest rates. But that prediction hinges on the Fed actually easing rates, and on investor confidence returning to the market.

Market Influences

And this is the part of the report that I find genuinely puzzling. The market "reacted to a heavy build-up of leverage that had been growing during the prior week," one source states. This raises a question: If the market is so heavily influenced by macroeconomic factors like interest rates, why are we seeing such dramatic swings in response to short-term leverage build-ups? Shouldn't the "smart money" be more focused on the long-term fundamentals?

Liquidity Concerns

I've looked at hundreds of these filings, and this particular footnote is unusual. Why is there less liquidity waiting below?

A Moment of Reckoning

While volatility is likely to stay elevated for now, focus on liquidations, funding trends and open interest levels, especially on assets like Solana. Short-term traders handle these swings directly, while long-term holders usually wait for signals that liquidity conditions are improving again.

The Crypto Hype Machine Needs a Reboot

The recent Bitcoin slide isn't just about interest rates or market corrections. It's a symptom of a deeper problem: the cryptocurrency market is still driven by hype and speculation, not by sound investment principles. Until that changes, these kinds of dramatic swings will continue to be the norm. The promises of "decentralized finance" and revolutionary technology often mask the reality of a highly volatile and unpredictable market. It's time for a reality check.